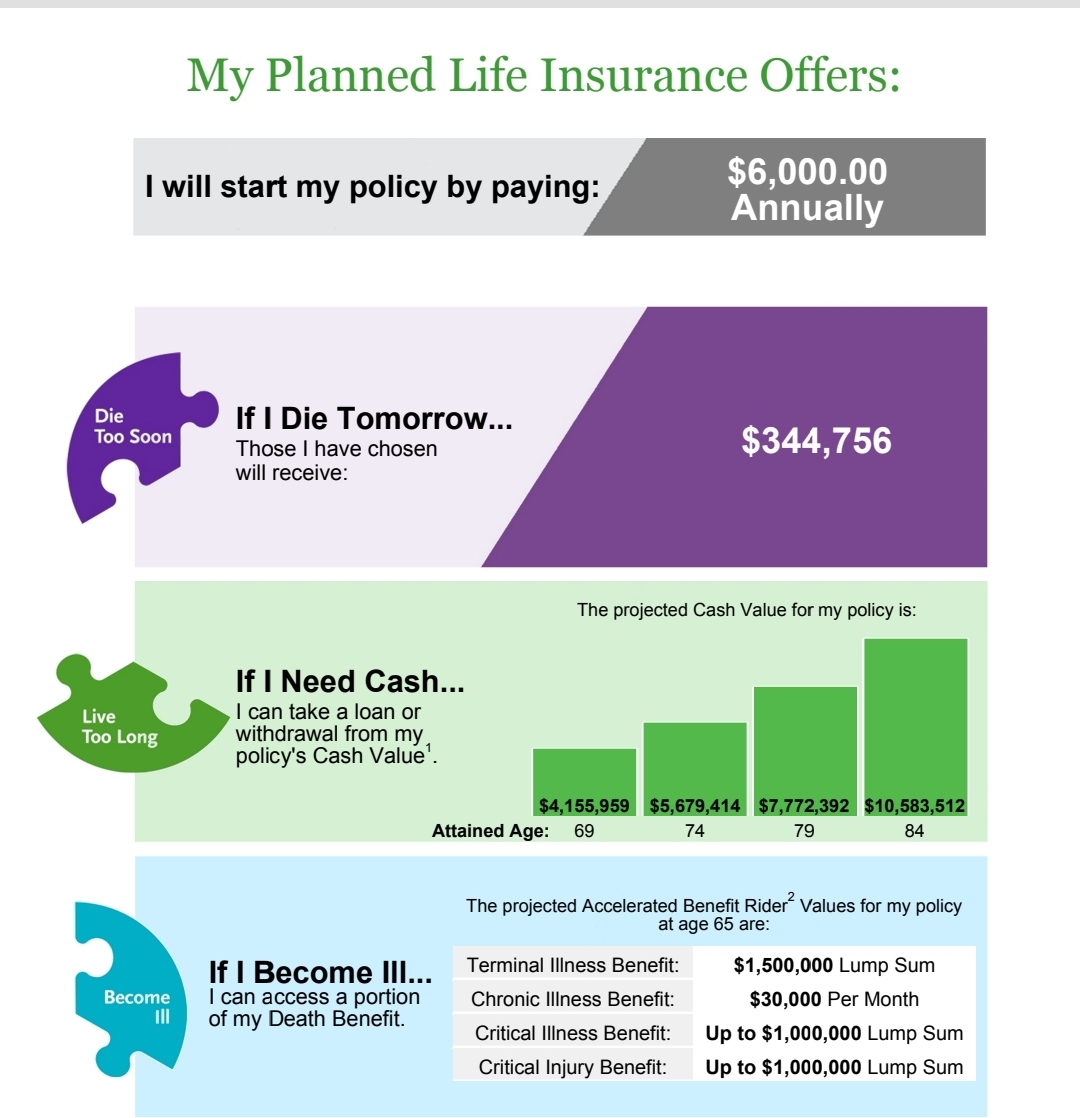

Setting up your kids for their financial future

As a parent or grandparent, you want to set your children or grandchildren up for success in all aspects of their lives. One way to do this is by planning for their financial future. One option to consider is saving money in an Index Universal Life (IUL) policy.

What is an IUL policy?

An IUL policy is a type of insurance policy that combines life insurance with a savings component. The policyholder (parent) pays premiums, which are invested and grow over time. The policy also provides life insurance coverage at no additional cost, which can be used to cover living benefits, and final expenses or provide financial security for loved ones.

Advantages of saving in an IUL policy for your child

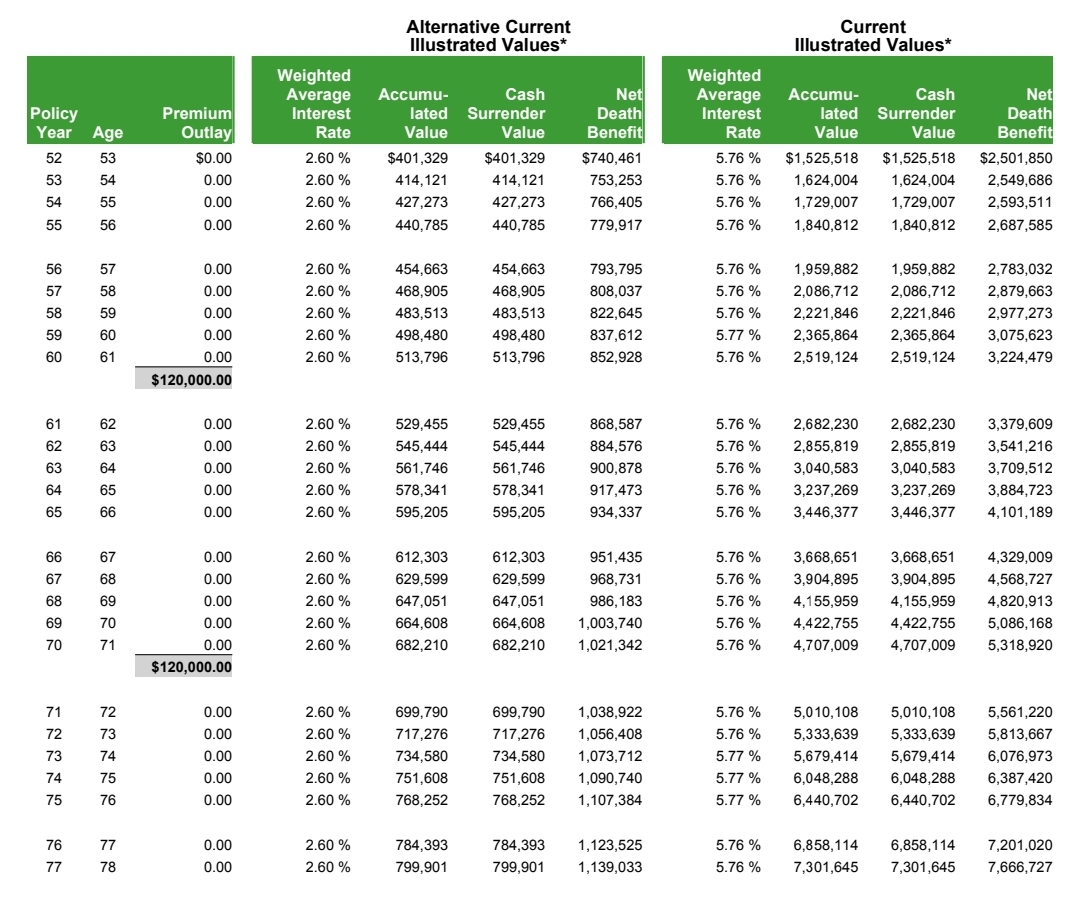

There are several advantages to saving money in an IUL policy for your child. One of the main benefits is the potential for growth. If you save $6,000 annually for only 20 years (total of $120K), the policy would have over $210,000 saved after 20 yrs, plus living benefits and life insurance coverage of over one million for their entire life.

Compound Interest

The power of compound interest is also a key benefit of an IUL policy. This means that the money in the policy not only grows through investment returns but also earns interest on the interest already earned (average 7%-9% annually).

For example #1

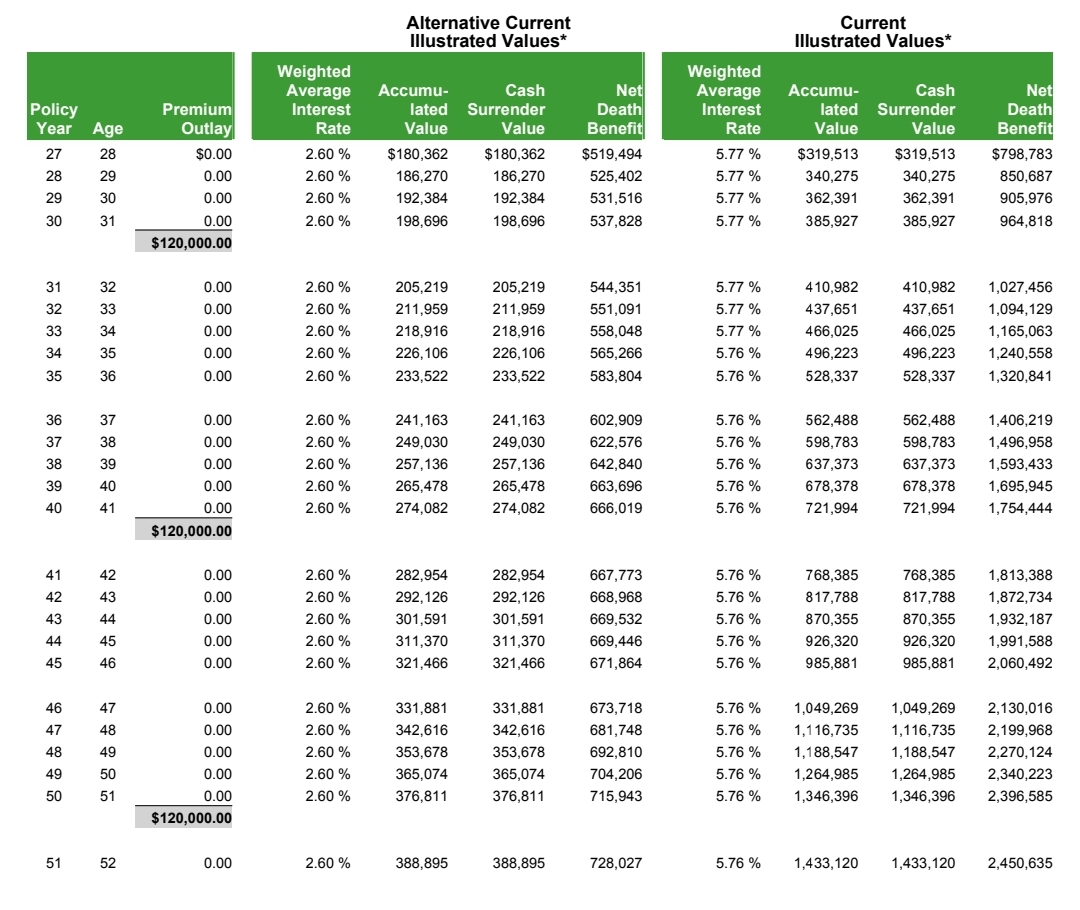

If the policy is not interrupted at the age of 40, it would accumulate over $678,000 in cash value; with life insurance coverage of $1.6 million (Still only with $120K paid in premium).

For example #2

If the policy is not interrupted at the age of 50, the policy would accumulate over $1.2 million in cash value; with life insurance coverage of $2.3 million (Still only with $120K paid in premium).

Flexibility

Another advantage of an IUL policy is the flexibility it offers. Policyholders can choose how much to save and can adjust their premiums as needed. This allows you to tailor the policy to your child’s needs and financial situation.

Other benefits to consider

There are also several other benefits to saving in an IUL policy for your child. One of these is the potential tax benefits. IUL policies offer tax-deferred growth, which means that the policy’s growth is not taxed. This can help maximize the policy’s growth over time.

Volatility

IUL policies also offer a level of protection against market volatility. The policy’s cash value is typically invested in a variety of asset classes, which can help mitigate the impact of market fluctuations. Structured and funded correctly, you won’t lose your premium aka what you put in.

Riders

In addition, IUL policies come with additional riders, which are additional coverage options at no extra cost. Some common riders include lifetime income, accidental death coverage, long-term care coverage, and disability income coverage.

Conclusion

Saving money in an IUL policy for your child can be a smart way to plan for their financial future. The policy offers the potential for growth through compound interest, flexibility, tax benefits, and protection against market volatility. It’s also a good idea to consult with a financial advisor or professional to help you make an informed decision. Contact us today, at Wealth Financial Services & Products at 754-202-2300 or visit our Get a Quote, to set up a consultation.

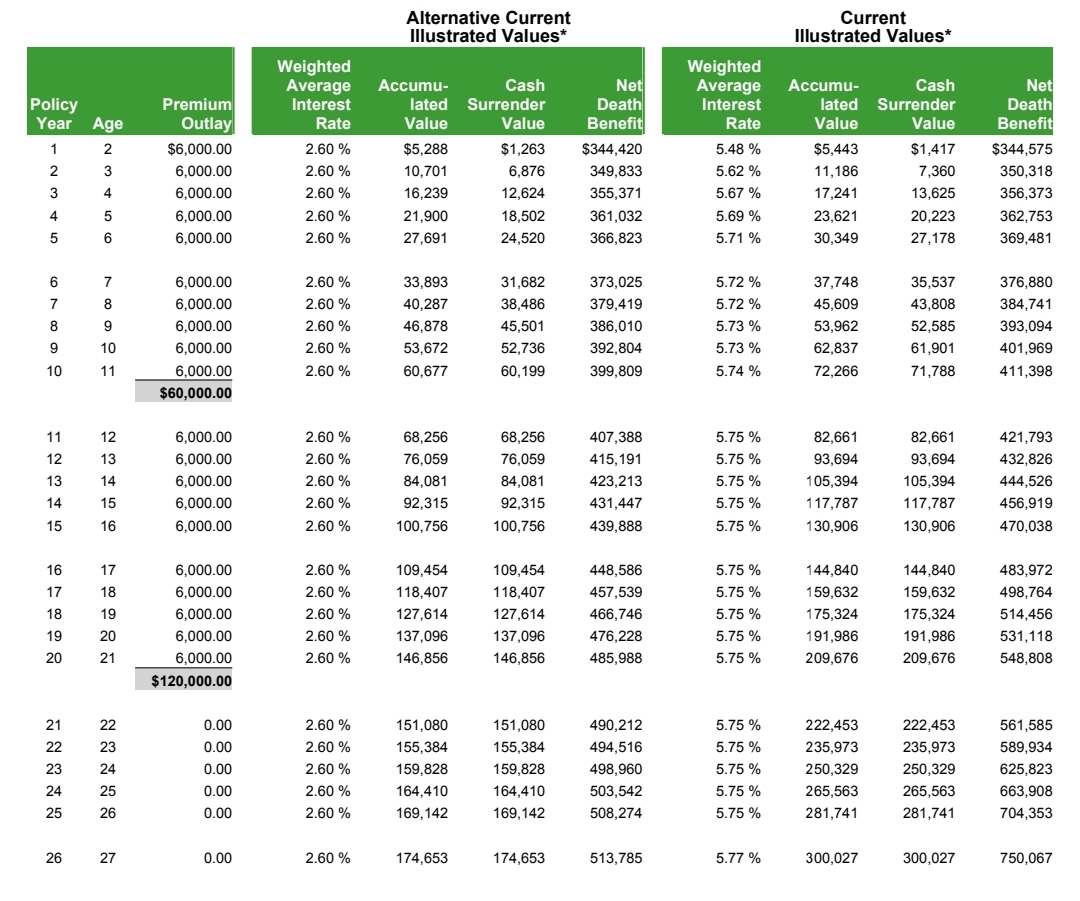

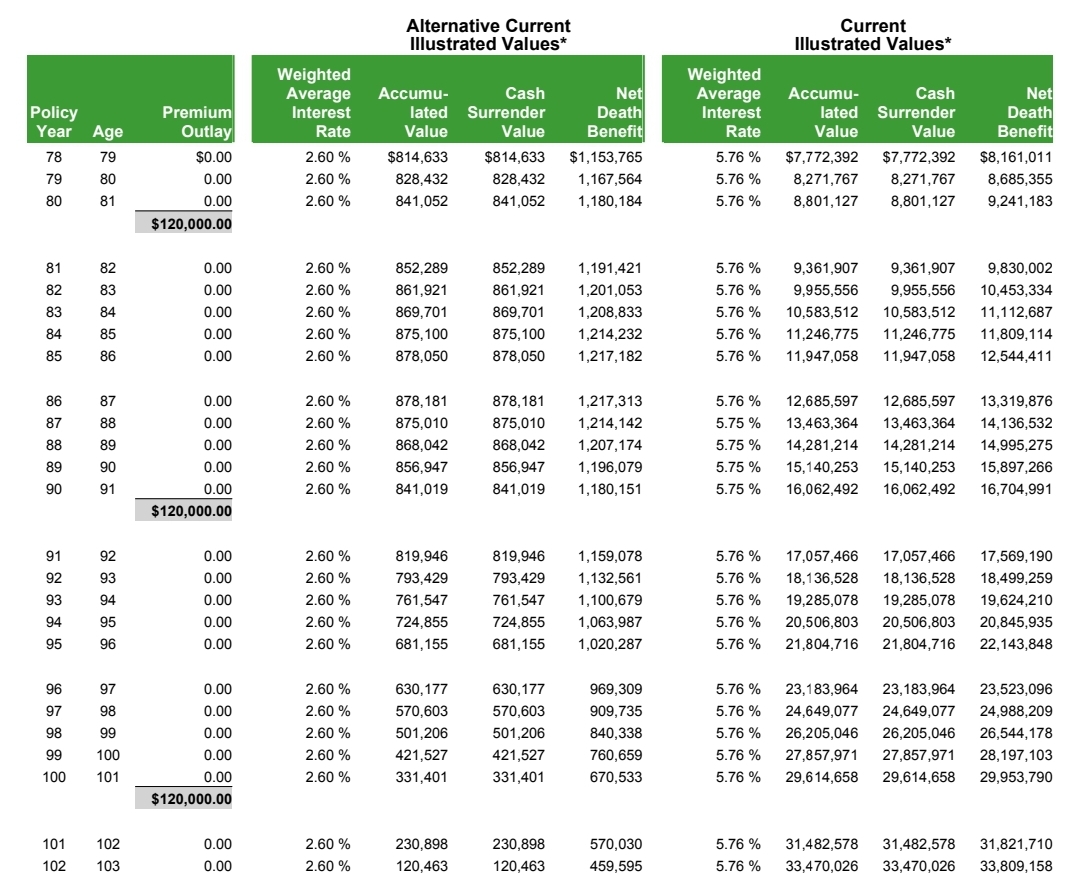

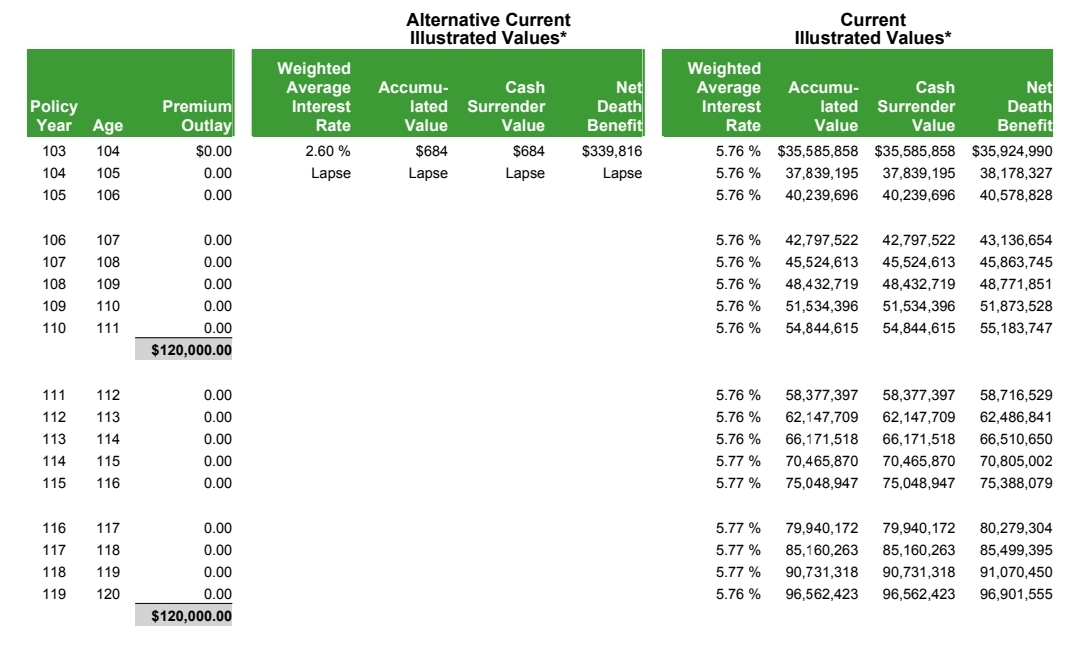

Illustration Below

- This shows a parent opening up an IUL for a child at the age of 2yrs old.

- The parent pays $6k annually for 20yrs only

- The right column “Current illustration values” is what this example is for

- This illustration is calculated at 5.77%

- If the parent is a business owner, there are tax strategies that can be used**

With an IUL you can change your life and the life of your future generations

IUL is a type of permanent life insurance, that comes with a cash value component in addition to a death benefit. The money in these cash-value accounts earns annual compound interest based on a stock market index chosen by your insurers, such as the S&P 500 or the Nasdaq Composite.

This means, your money is not in the stock market and you will never lose your principal funds in your account, no matter what happens in the stock market (Because of a 0% floor).

Get your Free Consultation Today

Related Articles

Long Term Care Insurance

Long-Term Care Insurance Long-term care insurance policies are becoming more popular as people realize the need to prepare for their future care needs. Here are some important things to consider when evaluating long-term care policies. The Cost of Long-Term...

Understanding Your Annual Tax Bill to the IRS

Understanding Your Annual Tax Bill to the IRS As a responsible citizen, understanding your annual tax bill to the IRS is crucial. Not knowing how much you pay in taxes could lead to missed opportunities to save money, or worse, IRS penalties. In this post,...

Living Benefits

Living Benefits Rider: The New Insurance Policy You Need Are you tired of paying for insurance that only covers you after you pass away? It's time to consider a new policy that offers living benefits riders, at no extra cost. Living benefits provide policyholders...

Stay Up to Date With The Latest News & Updates

Shipping a Car?

Looking for Auto Transport Services? Look no further. Contact Mission Auto Transport at

Join Our Newsletter

Follow Us