“Understanding Reasons US Families File for Bankruptcy and How to Prevent It”

Introduction:

Bankruptcy can be a difficult and challenging experience for families in the United States, with lasting financial and emotional consequences. Understanding the reasons behind these filings can help us identify measures to prevent such situations. In this post, we will explore common causes of bankruptcy, discuss preventive measures, and highlight the role of final expenses, term or permanent life insurance in avoiding financial hardships associated with unexpected medical bills and funeral costs.

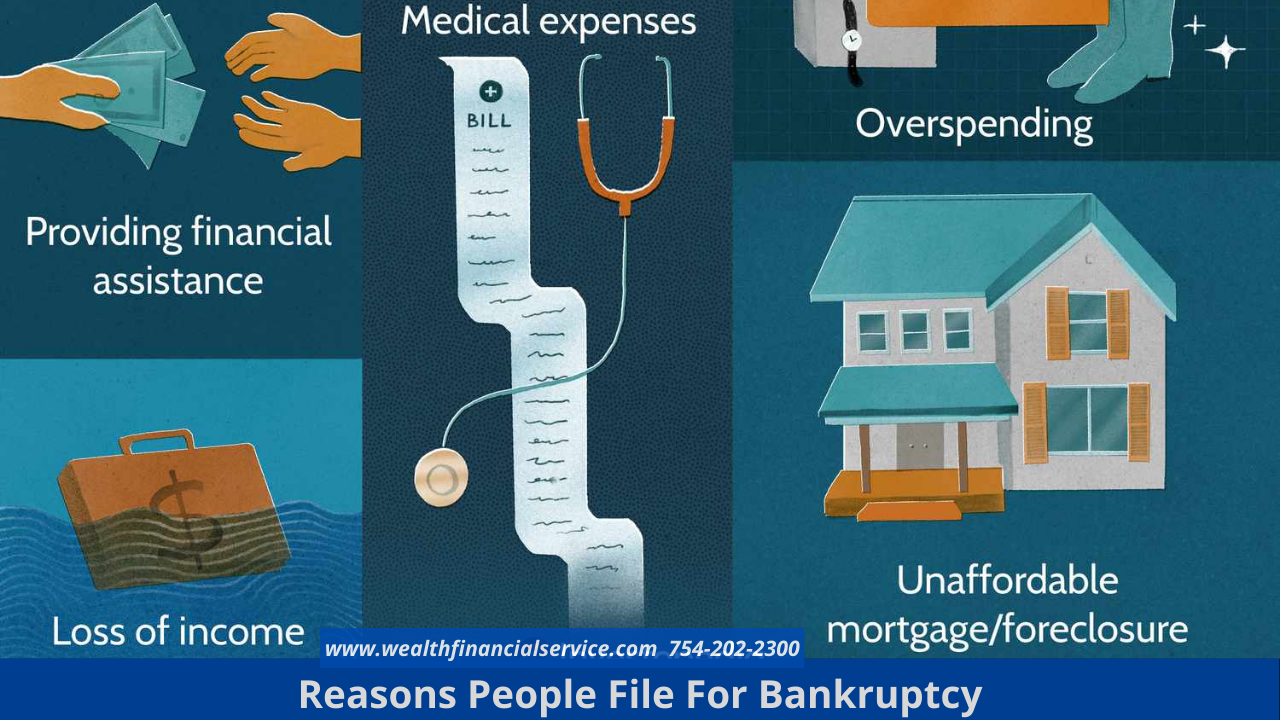

Reasons for Bankruptcy:

Medical Expenses

One of the leading reasons families file for bankruptcy is the burden of exorbitant medical bills. Healthcare costs in the US can quickly accumulate, leaving families financially overwhelmed and unable to meet other essential expenses.

Job Loss or Reduced Income

Sudden job loss or a significant reduction in income can cause families to struggle with their financial obligations. Without a steady source of income, it becomes challenging to cover monthly bills, debts, and maintain a decent standard of living.

Consumer Debt and Credit Cards

High levels of consumer debt, often accumulated through credit cards and loans, can become unmanageable for families. Balances with high-interest rates and minimum payments that barely cover interest charges can lead to a debt spiral, eventually leading to bankruptcy.

Preventive Measures:

Emergency Funds and Savings

Building an emergency fund and maintaining regular savings can provide a financial safety net during unexpected events such as medical emergencies or job loss. Having three to six months’ worth of living expenses set aside is a recommended goal.

Budgeting and Financial Planning

Creating and adhering to a budget is crucial for managing personal finances effectively. Regularly tracking income and expenses helps identify areas where spending can be reduced or eliminated, preventing the accumulation of excessive debt.

Health Insurance Coverage

Obtaining comprehensive health insurance coverage is essential for protecting against overwhelming medical expenses. Regularly reviewing insurance plans to ensure adequate coverage can help minimize out-of-pocket costs.

Role of Final Expenses, Term or Permanent Life Insurance:

Final Expenses, Term or permanent life insurance can be a valuable financial tool to protect families from the financial consequences of unexpected death. In the event of a loved one’s passing, life insurance benefits can cover funeral costs, outstanding debts, and provide financial stability for the surviving family members.

Cost of Medical Bills and Funeral Expenses:

The cost of medical bills can vary greatly depending on the condition and treatment required, often leaving families burdened with substantial debt. Funeral costs can also be a significant financial strain, ranging from several thousand to tens of thousands of dollars, depending on preferences and location (the average cost for a funeral is $15K).

Life Insurance as a Solution:

Purchasing a life insurance policy can alleviate the financial strain associated with medical bills and funeral costs. By paying regular premiums, families can ensure that they receive a lump sum benefit upon the policyholder’s death, providing necessary funds to cover these expenses without resorting to bankruptcy (The average final expense or term policy costs under $150 monthly).

Avoiding GoFundMe as a Responsible Solution:

While crowdfunding platforms like GoFundMe may seem like a temporary solution, they should not be relied upon as a responsible financial strategy. Depending on public donations for critical expenses is unpredictable, and funds may not be raised in time or in sufficient amounts. Life insurance offers a more dependable and proactive approach.

Conclusion:

Understanding the reasons behind US families filing for bankruptcy is crucial in developing preventive strategies. By building emergency funds, budgeting effectively, and obtaining adequate health insurance coverage, families can minimize their risk. Moreover, final expense, term or permanent life insurance plays a vital role in protecting families from the financial repercussions of unexpected medical bills and funeral costs. Let’s spread awareness and help families make informed decisions to secure their financial future. Share this post with your friends and family! Contact us today, at Wealth Financial Services & Products at 754-202-2300 or visit our Get a Quote, to set up a free consultation.

With an IUL you can change your life and the life of your future generations

IUL is a type of permanent life insurance, that comes with a cash value component in addition to a death benefit. The money in these cash-value accounts earns annual compound interest based on a stock market index chosen by your insurers, such as the S&P 500 or the Nasdaq Composite.

This means, your money is not in the stock market and you will never lose your principal funds in your account, no matter what happens in the stock market (Because of a 0% floor).

Get your Free Consultation Today

Related Articles

Understanding Your Annual Tax Bill to the IRS

Understanding Your Annual Tax Bill to the IRS As a responsible citizen, understanding your annual tax bill to the IRS is crucial. Not knowing how much you pay in taxes could lead to missed opportunities to save money, or worse, IRS penalties. In this post,...

Living Benefits

Living Benefits Rider: The New Insurance Policy You Need Are you tired of paying for insurance that only covers you after you pass away? It's time to consider a new policy that offers living benefits riders, at no extra cost. Living benefits provide policyholders...

What’s a LIRP?

LIRP The Life Insurance Retirement Plan A Life Insurance Retirement Plan, or LIRP, is a powerful financial tool that can help secure your retirement years. Here's what you need to know. Who can set up a LIRP? Anyone can set up a LIRP, but it is typically most...

Stay Up to Date With The Latest News & Updates

Shipping a Car?

Looking for Auto Transport Services? Look no further. Contact Mission Auto Transport at

Join Our Newsletter

Follow Us