Understanding Your Annual Tax Bill to the IRS

As a responsible citizen, understanding your annual tax bill to the IRS is crucial. Not knowing how much you pay in taxes could lead to missed opportunities to save money, or worse, IRS penalties. In this post, we’ll discuss everything you need to know about your tax bill to ensure you’re informed and prepared come tax season.

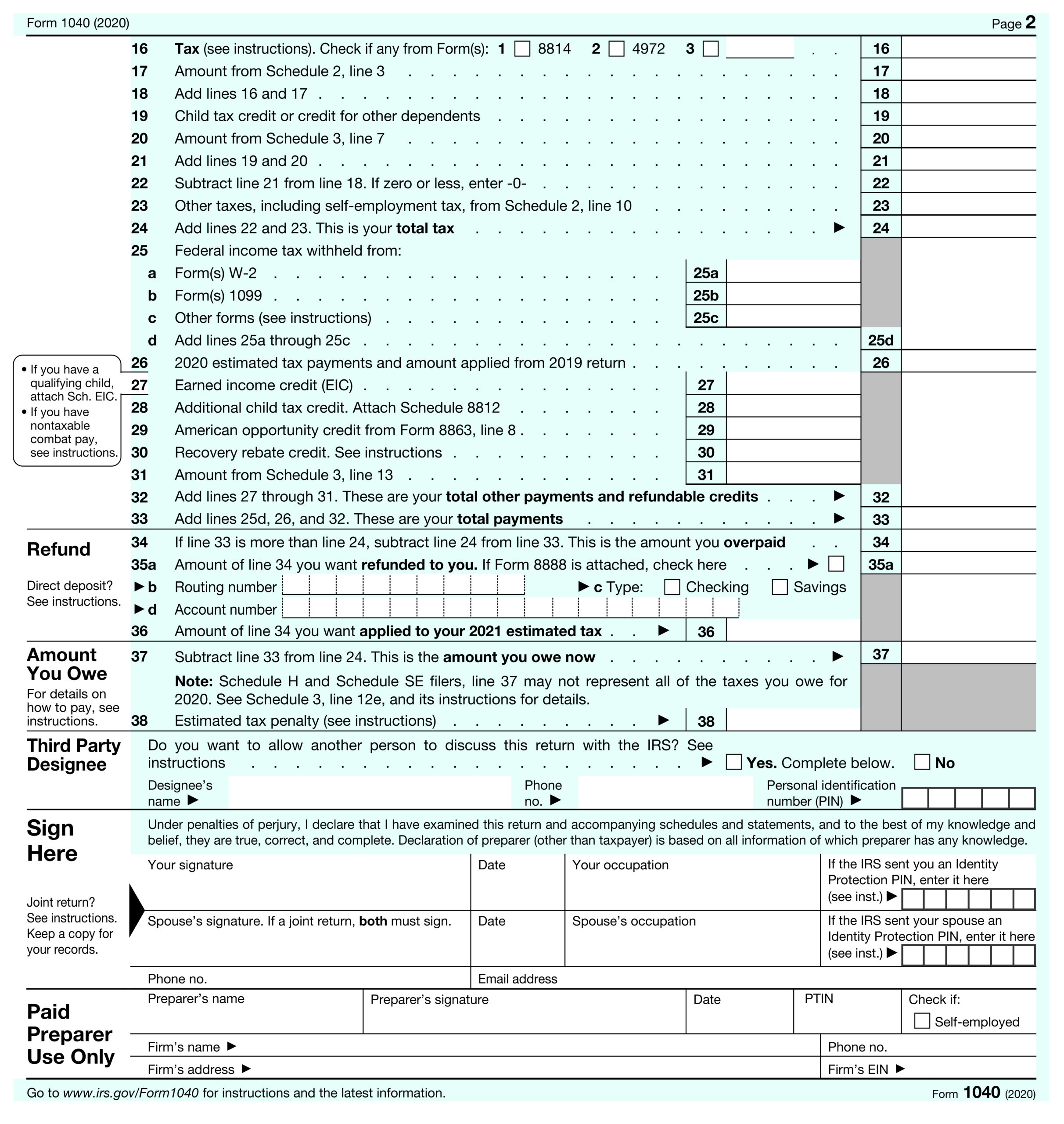

Finding Your Annual Tax Bill: Looking at Your 1040 Form

If you’re unsure about how much you pay in taxes each year, don’t worry. The information you need can be found on your 1040 form, which is used to file your federal tax return. Simply look at line 18 (total tax) and line 23 (total payments and refundable credits), and add the amounts. This sum represents the total amount of taxes you paid to the IRS that year.

Saving on Taxes: Becoming a Business Owner

One of the best ways to save on taxes is by becoming a business owner. When you run a business, you can take advantage of numerous deductions and credits that can significantly reduce your tax bill. For example, you can deduct expenses related to your business, such as rent, utilities, and office supplies. You can also take advantage of tax credits, such as the Small Business Health Care Tax Credit, which can help you cover the cost of providing health insurance to your employees.

Tax Planning for Business

If you have a business that makes more than $50k annually, you should consider hiring a bookkeeper and tax planner. These 2 jobs will save a business in taxes and will help from getting audited by the IRS. If this is something you’re interested in please contact us today, at Wealth Financial Services & Products at 754-202-2300 or visit our Get a Quote, to set up a consultation.

Conclusion: Stay Informed and Prepared

In conclusion, understanding your annual tax bill to the IRS is essential. By knowing how much you pay in taxes each year, you can take advantage of opportunities to save money and avoid penalties. Remember to look at your 1040 form and add up the amounts on lines 18 and 23 to find your total tax bill. And if you’re looking to save on taxes, consider becoming a business owner to take advantage of valuable deductions and credits. Share this post with your friends and family to ensure they’re informed and prepared for tax season too.

With an IUL you can change your life and the life of your future generations

IUL is a type of permanent life insurance, that comes with a cash value component in addition to a death benefit. The money in these cash-value accounts earns annual compound interest based on a stock market index chosen by your insurers, such as the S&P 500 or the Nasdaq Composite.

This means, your money is not in the stock market and you will never lose your principal funds in your account, no matter what happens in the stock market (Because of a 0% floor).

Get your Free Consultation Today

Related Articles

Long Term Care Insurance

Long-Term Care Insurance Long-term care insurance policies are becoming more popular as people realize the need to prepare for their future care needs. Here are some important things to consider when evaluating long-term care policies. The Cost of Long-Term...

Living Benefits

Living Benefits Rider: The New Insurance Policy You Need Are you tired of paying for insurance that only covers you after you pass away? It's time to consider a new policy that offers living benefits riders, at no extra cost. Living benefits provide policyholders...

What’s a LIRP?

LIRP The Life Insurance Retirement Plan A Life Insurance Retirement Plan, or LIRP, is a powerful financial tool that can help secure your retirement years. Here's what you need to know. Who can set up a LIRP? Anyone can set up a LIRP, but it is typically most...

Stay Up to Date With The Latest News & Updates

Shipping a Car?

Looking for Auto Transport Services? Look no further. Contact Mission Auto Transport at

Join Our Newsletter

Follow Us