Boli

Introduction

BOLI, or Bank Owned Life Insurance, is a type of life insurance that is purchased and held by national banks. But how much money do banks have invested in BOLI and which banks have the most holdings? In this post, we’ll explore the ins and outs of BOLI and the top banks with the most investments in this type of insurance.

What is BOLI?

BOLI is a type of life insurance that is purchased by national banks and held on their balance sheet. Banks can use the cash value of these policies to offset the cost of employee benefit plans and provide a source of liquidity. BOLI policies can also be used as a way to generate income for the bank.

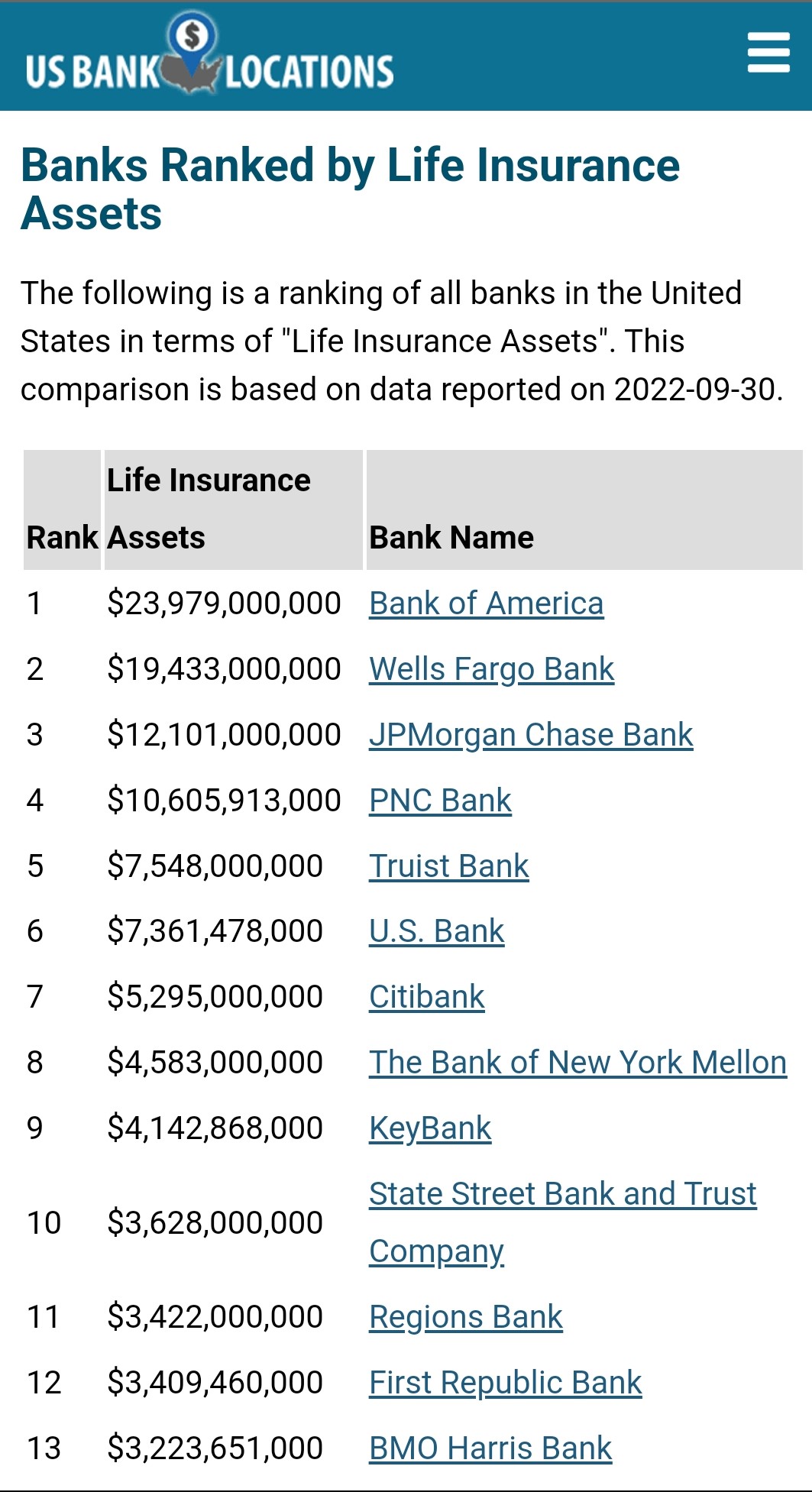

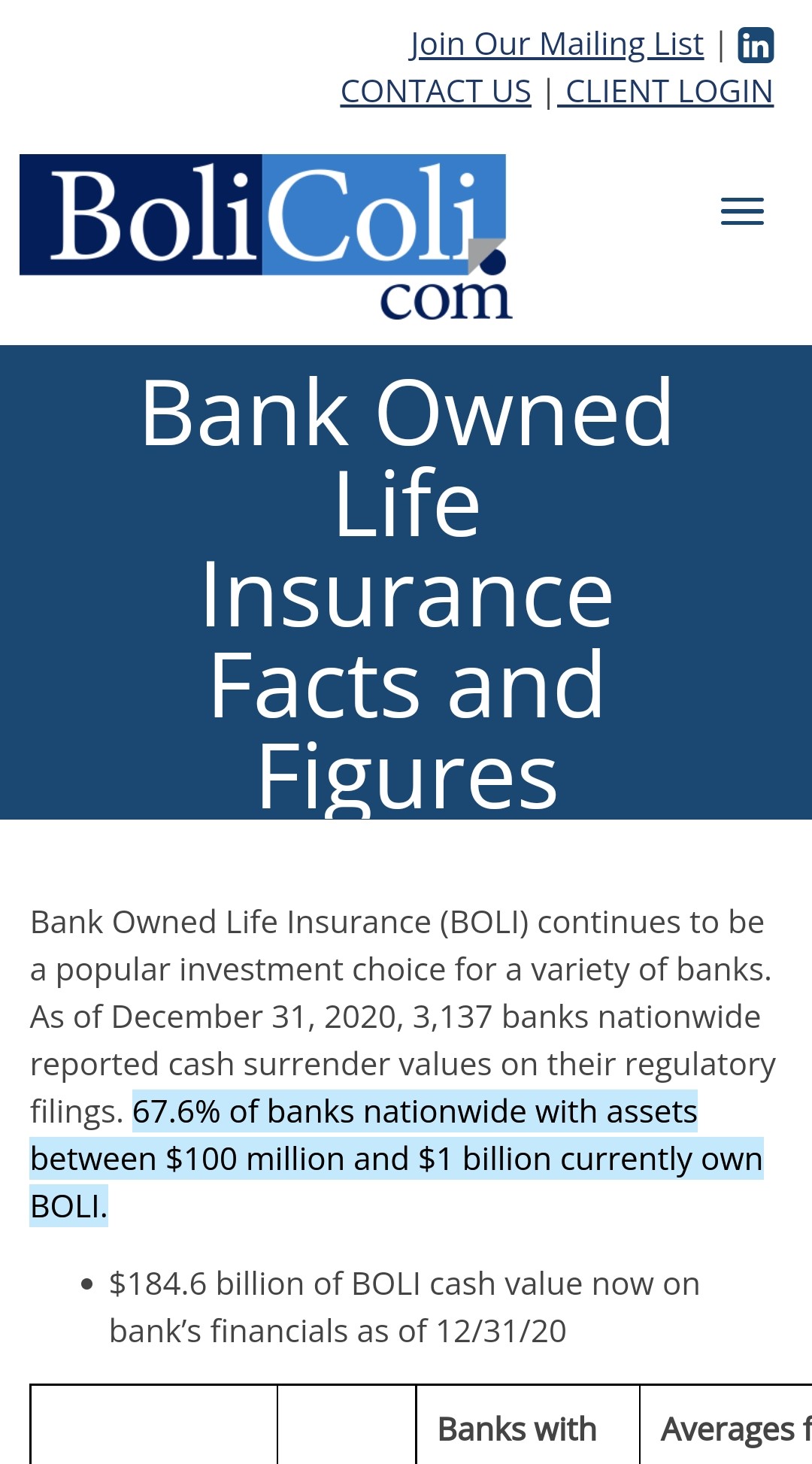

How Much do Banks have in BOLI?

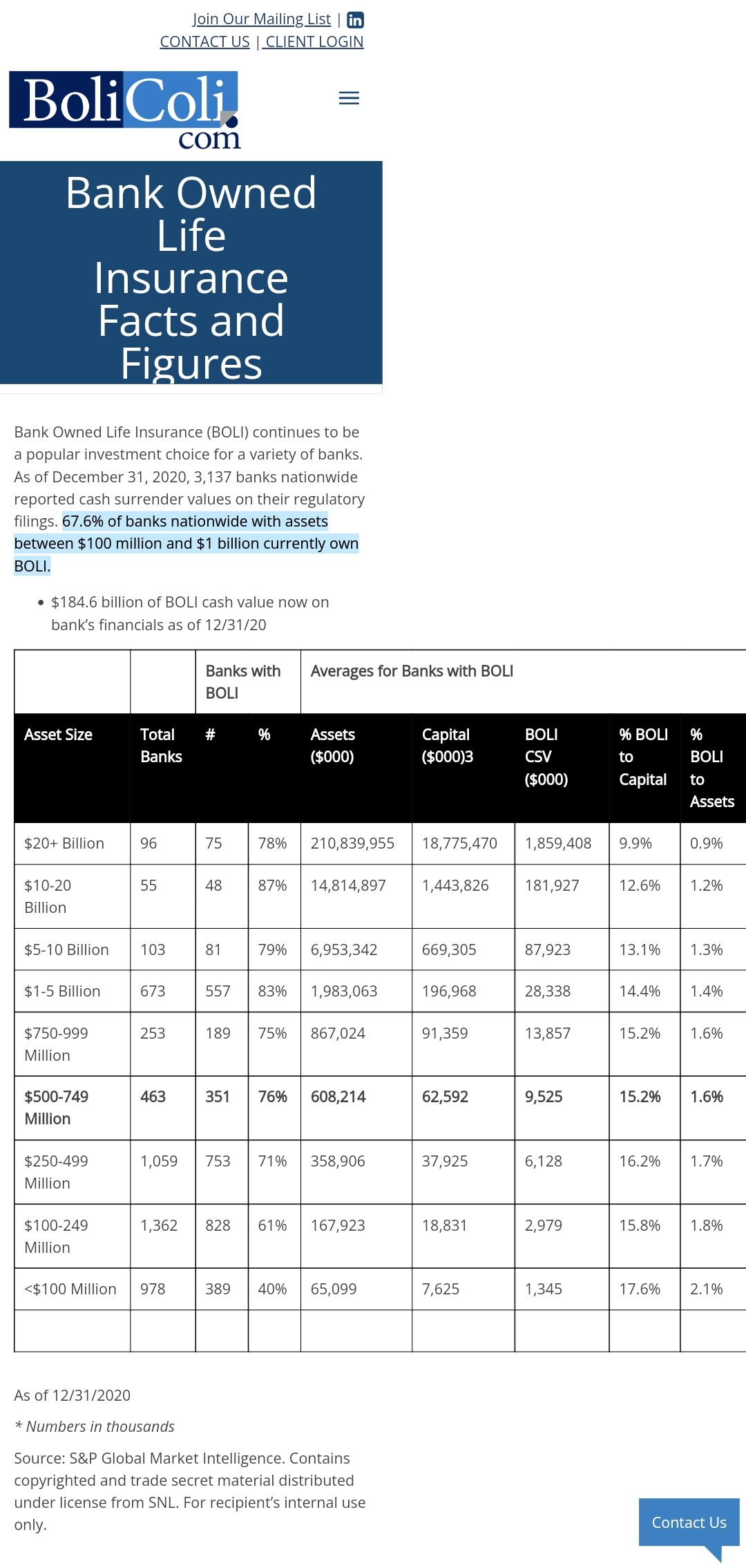

According to the Office of the Comptroller of the Currency (OCC), national banks had $182 billion in BOLI assets as of December 2019. This represents a significant portion of banks’ total assets and can provide a significant source of income for banks.

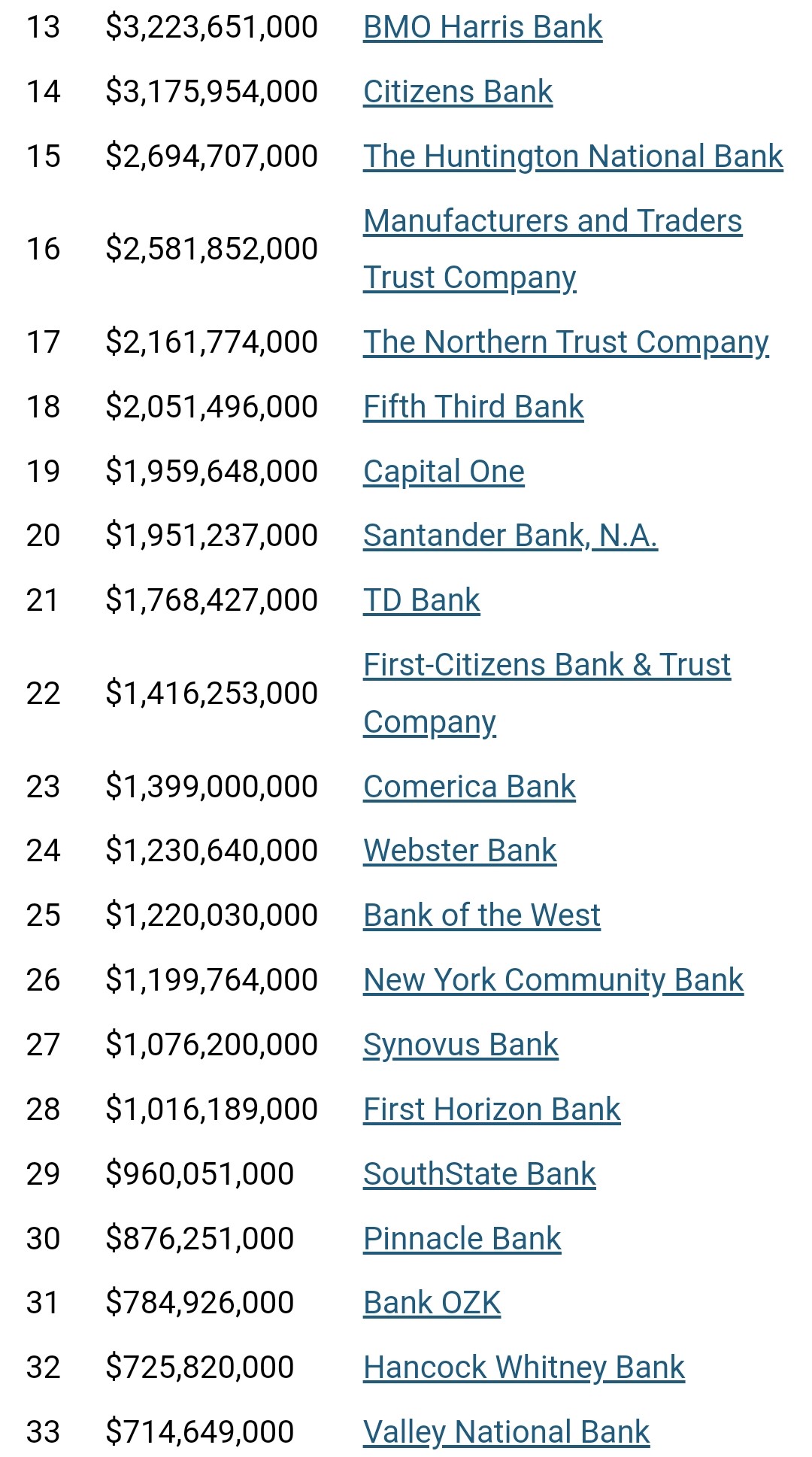

Top Banks with BOLI Holdings:

- JPMorgan Chase – $46 billion

- Wells Fargo – $34 billion

- Bank of America – $27 billion

These top three banks account for nearly half of all BOLI assets held by national banks.

Conclusion

Understanding BOLI and the role it plays in banks’ financials can help us better understand the banking industry as a whole. With that being said, Banks consider life insurance as a safe place to put a large portion of their assets. Savvy people and the elites have been doing the same thing with their money for years. It’s also a good idea to consult with a financial advisor or professional to help you make an informed decision. Contact us today, at Wealth Financial Services & Products at 754-202-2300 or visit our Get a Quote, to set up a consultation.

See Below

With an IUL you can change your life and the life of your future generations

IUL is a type of permanent life insurance, that comes with a cash value component in addition to a death benefit. The money in these cash-value accounts earns annual compound interest based on a stock market index chosen by your insurers, such as the S&P 500 or the Nasdaq Composite.

This means, your money is not in the stock market and you will never lose your principal funds in your account, no matter what happens in the stock market (Because of a 0% floor).

Get your Free Consultation Today

Related Articles

Long Term Care Insurance

Long-Term Care Insurance Long-term care insurance policies are becoming more popular as people realize the need to prepare for their future care needs. Here are some important things to consider when evaluating long-term care policies. The Cost of Long-Term...

Understanding Your Annual Tax Bill to the IRS

Understanding Your Annual Tax Bill to the IRS As a responsible citizen, understanding your annual tax bill to the IRS is crucial. Not knowing how much you pay in taxes could lead to missed opportunities to save money, or worse, IRS penalties. In this post,...

Living Benefits

Living Benefits Rider: The New Insurance Policy You Need Are you tired of paying for insurance that only covers you after you pass away? It's time to consider a new policy that offers living benefits riders, at no extra cost. Living benefits provide policyholders...

Stay Up to Date With The Latest News & Updates

Shipping a Car?

Looking for Auto Transport Services? Look no further. Contact Mission Auto Transport at

Join Our Newsletter

Follow Us