Term Life Insurance

Introduction

“Are you aware of the benefits and drawbacks of term insurance? Keep reading to learn more about this important coverage option.”

Old vs New Term Insurance

“When it comes to term insurance, it’s important to know the difference between old and new policies. Old-term insurance plans did not offer living benefits, while new ones do. This means that new term insurance policies can provide financial support while the policyholder is still alive, not just after they pass away.”

Group Life Insurance vs Personal Term Insurance

“Many employers offer group life insurance as a benefit, but these policies typically only provide coverage of $50k or $100k. To get additional coverage, employees may have to pay out of pocket. Additionally, group life insurance ends when the employee no longer works for that company. A personal term insurance policy, on the other hand, can be converted to a permanent life insurance policy with cash value.”

Term Insurance Duration

“Term insurance policies can last for a period of 10 to 30 years. This means that policyholders can choose a term that aligns with their financial goals and needs. For example, a 30-year term policy may be more beneficial for someone who wants to ensure that their family is financially secure in the event of their death.”

Converting a Term to a Permanent Policy

Most new Term Life Insurance policies can be converted to permanent policies. These new Term policies come with riders which include long-term care and policy conversion. Pay attention on the conversion window of these policies.

For issue ages up to and including age 65:

The conversion period ends at the sooner of age 70 OR…

Term 10-G: 10 years from the issue date

Term 15-G: 12 years from the issue date

Term 20-G: 15 years from the issue date

Term 30-G: 20 years from the issue date

For issue ages over 65:

The conversion period ends 5 years from the issue date,

regardless of the term period.

Conclusion

“In conclusion, term insurance is an important coverage option that can provide financial support for your loved ones in the event of your death. However, it’s important to be aware of the differences between old and new policies, and between group life insurance and personal term insurance. By understanding these differences, you can make an informed decision about the right coverage for you and your family.” It’s also a good idea to consult with a financial advisor or professional to help you make an informed decision. Contact us today, at Wealth Financial Services & Products at 754-202-2300 or visit our Get a Quote, to set up a consultation.

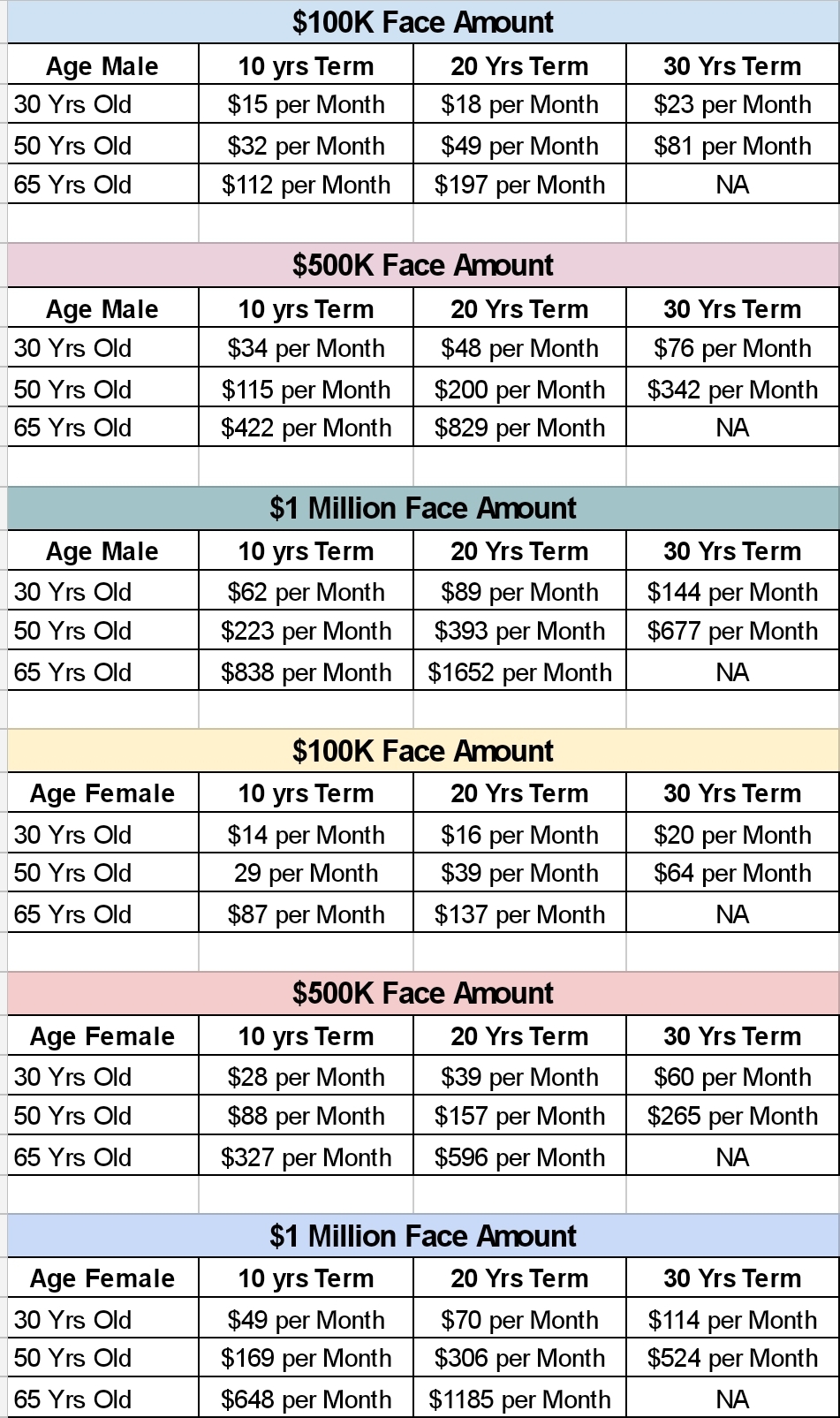

See below some examples of the cost of Term Life Insurance based on Sex-Age & Face Amount

With an IUL you can change your life and the life of your future generations

IUL is a type of permanent life insurance, that comes with a cash value component in addition to a death benefit. The money in these cash-value accounts earns annual compound interest based on a stock market index chosen by your insurers, such as the S&P 500 or the Nasdaq Composite.

This means, your money is not in the stock market and you will never lose your principal funds in your account, no matter what happens in the stock market (Because of a 0% floor).

Get your Free Consultation Today

Related Articles

Long Term Care Insurance

Long-Term Care Insurance Long-term care insurance policies are becoming more popular as people realize the need to prepare for their future care needs. Here are some important things to consider when evaluating long-term care policies. The Cost of Long-Term...

Understanding Your Annual Tax Bill to the IRS

Understanding Your Annual Tax Bill to the IRS As a responsible citizen, understanding your annual tax bill to the IRS is crucial. Not knowing how much you pay in taxes could lead to missed opportunities to save money, or worse, IRS penalties. In this post,...

Living Benefits

Living Benefits Rider: The New Insurance Policy You Need Are you tired of paying for insurance that only covers you after you pass away? It's time to consider a new policy that offers living benefits riders, at no extra cost. Living benefits provide policyholders...

Stay Up to Date With The Latest News & Updates

Shipping a Car?

Looking for Auto Transport Services? Look no further. Contact Mission Auto Transport at

Join Our Newsletter

Follow Us