Retirement Contribution Limits

Introduction

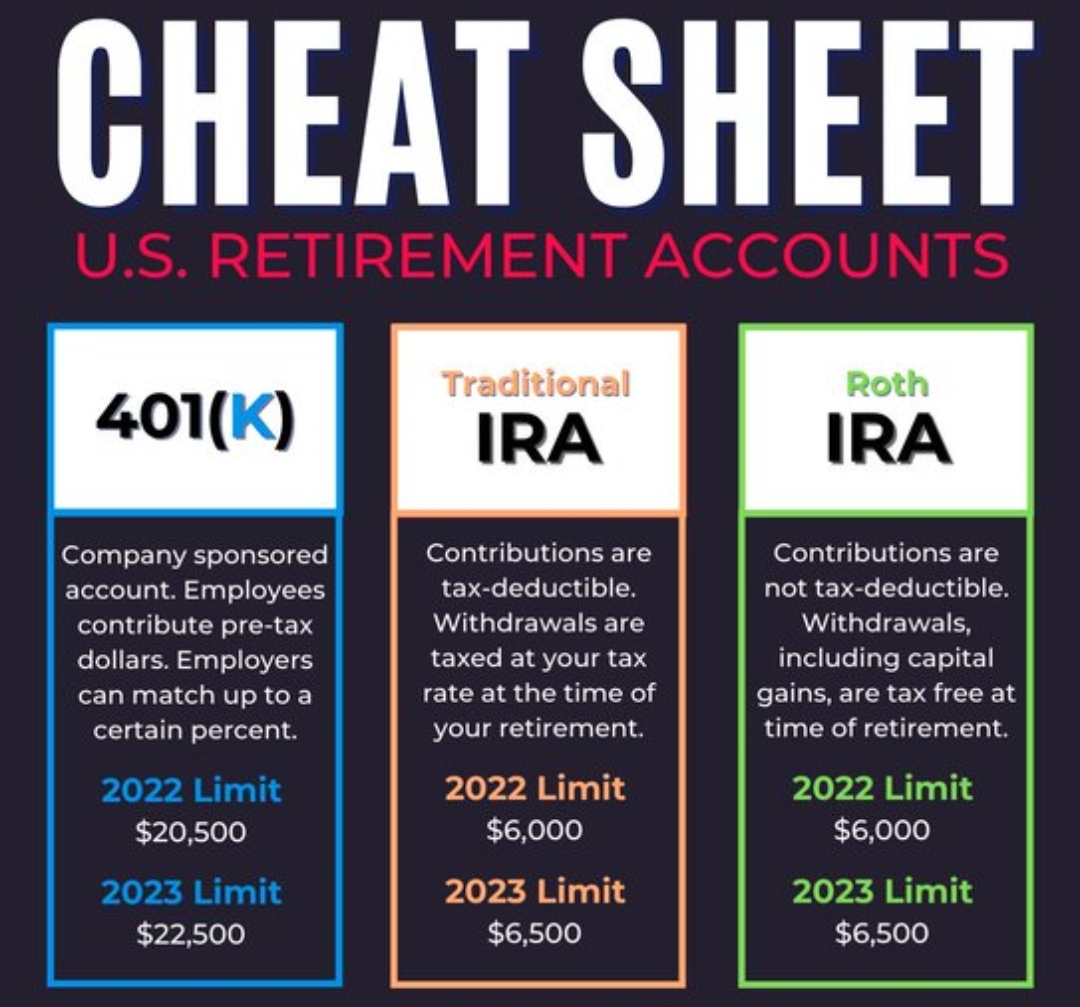

- Contributions limits for retirement accounts such as 401K, IRA, and Roth IRA have been set at $22,500 for 2023, with catch-up contributions for those over 50 at $6,500.

- For high-income earners, there are additional restrictions on Roth IRA contributions.

- An alternative is an IUL-Index Universal Life policy, which has no annual contribution limits.

401K, IRA, and Roth IRA Limits

- 401K contributions are limited to $22,500 for 2023, with catch-up contributions at $6,500 for those over 50.

- IRA contributions are limited to $6,500 for 2023, with catch-up contributions at $1,000 for those over 50.

- Roth IRA contributions are limited to $6,500 for 2023, with catch-up contributions at $1,000 for those over 50.

- For those earning over $144,000 annually as a single filer or $214,000 as a married joint filer, Roth IRA contributions are further restricted.

IUL-Index Universal Life Policy

- An IUL-Index Universal Life policy has no annual contribution limits.

- This option allows high-income earners to contribute more than the annual limits set on traditional retirement accounts.

- In addition to investment opportunities, an IUL policy also includes life insurance and living benefits at no additional cost.

Conclusion

- Retirement account contribution limits can restrict the ability of high-income earners to save for retirement.

- An IUL-Index Universal Life policy offers an alternative with no annual contribution limits and added benefits such as accessing your funds Tax-free, life insurance, and living benefits.

- It’s important to carefully consider your options and choose a plan that aligns with your financial priorities and budget.

- It’s also a good idea to consult with a financial advisor or professional to help you make an informed decision. Contact us today, at Wealth Financial Services & Products at 754-202-2300 or visit our Get a Quote, to set up a consultation.

With an IUL you can change your life and the life of your future generations

IUL is a type of permanent life insurance, that comes with a cash value component in addition to a death benefit. The money in these cash-value accounts earns annual compound interest based on a stock market index chosen by your insurers, such as the S&P 500 or the Nasdaq Composite.

This means, your money is not in the stock market and you will never lose your principal funds in your account, no matter what happens in the stock market (Because of a 0% floor).

Get your Free Consultation Today

Related Articles

Long Term Care Insurance

Long-Term Care Insurance Long-term care insurance policies are becoming more popular as people realize the need to prepare for their future care needs. Here are some important things to consider when evaluating long-term care policies. The Cost of Long-Term...

Understanding Your Annual Tax Bill to the IRS

Understanding Your Annual Tax Bill to the IRS As a responsible citizen, understanding your annual tax bill to the IRS is crucial. Not knowing how much you pay in taxes could lead to missed opportunities to save money, or worse, IRS penalties. In this post,...

Living Benefits

Living Benefits Rider: The New Insurance Policy You Need Are you tired of paying for insurance that only covers you after you pass away? It's time to consider a new policy that offers living benefits riders, at no extra cost. Living benefits provide policyholders...

Stay Up to Date With The Latest News & Updates

Shipping a Car?

Looking for Auto Transport Services? Look no further. Contact Mission Auto Transport at

Join Our Newsletter

Follow Us