IUL- Index Universal Life Insurance Explained

You have made the smart decision to get life insurance! You want to protect your family in case a tragedy may occur. Your next question may be, what kind of life insurance should I get? There are a few choices and it may be overwhelming for someone who is unfamiliar with the life insurance market and what is available to you. Here we will take a look at one of the more popular forms of life insurance, index universal life insurance. This should better prepare you to select the type of life insurance that makes the most sense for you and your family’s needs!

What is Index Universal Life Insurance?

Index universal life insurance is a cash-value life insurance policy. It is also a permanent insurance option that covers the insured person for their whole life rather than just a set period of time. These policies use a small percentage of the premium payments towards the annual renewal, and the rest to the cash value of the policy.

On a monthly or annual basis, the cash value is credited to the policy. This includes interest based on increases in an equity index. The typical interest rate is about 7%- 13% with a 0% floor. Even if the market is down, you won’t ever lose your principal balance which makes an IUL a great investment and retirement tool.

What are Living Benefits?

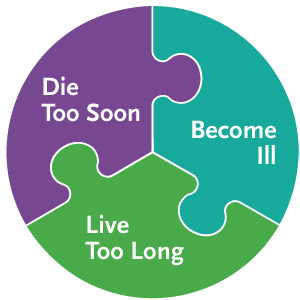

Life insurance can do more than pay a death benefit. With powerful riders, you may be able to accelerate the death benefit due to qualifying illness or injury and potentially provide a guaranteed source of retirement income if you live too long. Accelerated benefits riders are optional, no additional cost riders that can allow you to access all or part of the death benefit while you’re living if you experience a qualifying terminal, chronic or critical illness or critical injury.

Death Benefits on an Index Universal Life Insurance Plan

When you select an Index Universal Life Insurance policy you will have two different choices when it comes to the death benefit. You could select a level death benefit or an increasing death benefit. A level death benefit stays the same the whole life of the policy, whereas an increasing death benefit will include the cash value that is built as you pay your premiums. Since the increasing death benefit will have a higher payout, you will pay higher premiums with a plan like this.

Why Should You Get An Index Universal Life Policy?

Many people use Index Universal Life insurance policies as savings vessels. They work great for this because they can provide you with flexibility and tax-free gains. They work well for those with a large up-front investment to make. You also have the option to borrow from the cash value at any time. If you are seeking options to reduce your tax burden during retirement, an Index Universal Life insurance plan may be right for you.

Conclusion

Now that we’ve explored the basics of Index Universal Life Insurance, you should have a better grasp of if this type of plan may work best for your particular situation and needs. There are many different factors to consider when selecting a life insurance policy. It is always important to work with a reputable licensed life insurance agent to guide you through the process of selecting and obtaining a life insurance policy. Feel free to contact us here at Wealth Financial Services & Products at 754-202-2300 or visit our Get a Quote, email us at info@wealthfinancialservice.com and we will be happy to start a conversation on how we can best serve your needs.

With an IUL you can change your life and the life of your future generations

IUL is a type of permanent life insurance, that comes with a cash value component in addition to a death benefit. The money in these cash-value accounts earns annual compound interest based on a stock market index chosen by your insurers, such as the S&P 500 or the Nasdaq Composite.

This means, your money is not in the stock market and you will never lose your principal funds in your account, no matter what happens in the stock market (Because of a 0% floor).

Get your Free Consultation Today

Related Articles

Long Term Care Insurance

Long-Term Care Insurance Long-term care insurance policies are becoming more popular as people realize the need to prepare for their future care needs. Here are some important things to consider when evaluating long-term care policies. The Cost of Long-Term...

Understanding Your Annual Tax Bill to the IRS

Understanding Your Annual Tax Bill to the IRS As a responsible citizen, understanding your annual tax bill to the IRS is crucial. Not knowing how much you pay in taxes could lead to missed opportunities to save money, or worse, IRS penalties. In this post,...

Living Benefits

Living Benefits Rider: The New Insurance Policy You Need Are you tired of paying for insurance that only covers you after you pass away? It's time to consider a new policy that offers living benefits riders, at no extra cost. Living benefits provide policyholders...

Stay Up to Date With The Latest News & Updates

Shipping a Car?

Looking for Auto Transport Services? Look no further. Contact Mission Auto Transport at

Join Our Newsletter

Follow Us