Introduction to Whole Life Insurance

Used interchangeably, whole life insurance or permanent life policy is a contract between the individual who owns the policy aka the policy owner, the insurer and the insurance company. Whole-life policies provide protection or coverage for one’s entire life. These contracts remain in force as long as the premiums are paid or if the policy expires at age 100. Like term policies, permanent policies offer a variety of different types.

Types of Permanent Policies

These may include whole life as we are discussing, universal life policies, variable life policies, indexed universal life policies, and variable universal life policies. The main takeaway from this article is that all these policies last for your lifetime.

Protection and Savings

The basic concept of life insurance is that it provides or creates an INSTANT ESTATE, for loved ones when the insured pass. There should be no better feeling than knowing your loved ones will and should have this type of protection. Life insurance also provides income for your family in case of any type of unexpected event. Policies of this nature can even provide childcare services, no better feeling in the world than knowing even your young children are covered financially.

Life Insurance is for you while you’re alive

For emphasis, the main reason to get life insurance ASAP is to provide financial protection for yourself and your family. An important point to note is that while the policy has a built-in savings feature, policies also have an investment component in them as well. The general misconception is that life insurance is not and should not be considered an insurance decision. Acquiring life insurance is actually an investment/saving decision.

Considerations When Choosing Policy Type

1. Insurer age and premium amount (monthly or annually)

2. Face amount coverage

3. Retirement income needs

4. Specialized needs (children’s college education)

Other options

The bottom line, individuals and families should review the types of policies they are considering purchasing. The great news is that there are riders (additional benefits) and provisions that can be added to the policy.

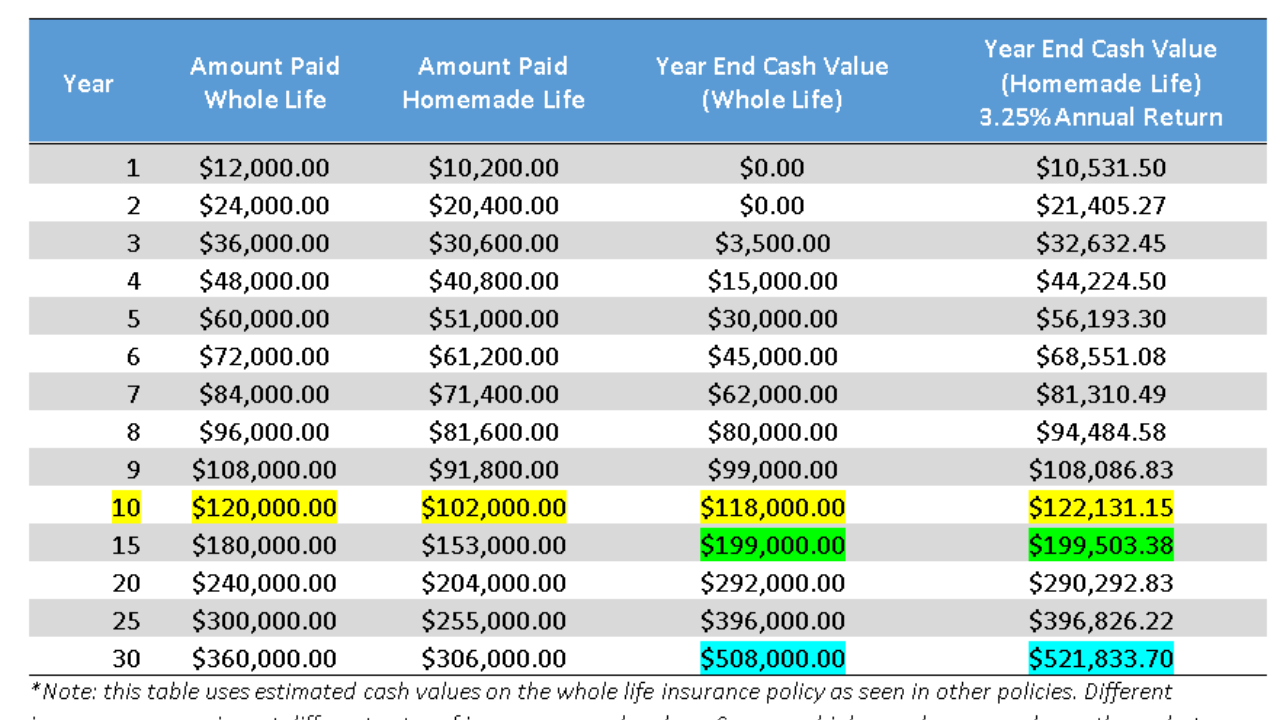

Cash values are also critical components of life or a permanent policy. These are called value life policies, which generate the saving element in the policy. The size of the cash value build-up is different with respect to insurance companies.

Things To Consider

1. Premiums, cash value and benefits are guaranteed

2. Cash-value growth is tax-deferred

3. Policy is for life providing premiums are paid

4. Premiums are usually higher than the term, but remain constant or fixed.

5. Cash value can be withdrawn after a couple of years

6. Compound interest

7. All policies come with Living benefits

This is what the wealthy have been using for years, copy the blueprint.

Armed with this information, individuals and families now have no excuse not to go and create their own estate. Life insurance contracts are the most appropriate tools to accelerate this process and if anyone does not have a life policy, then the question is; what are you waiting for?

Conclusion

So, there you have it, a primer on what Whole life policies can do and should do as part of your financial arsenal. A lot of people are now realizing the benefits of Cash value policies over banks’ accounts. You get what you pay for most of the time, so just make sure to do your due diligence before, feel free to contact us here at Wealth Financial Services & Products at 754-202-2300 or visit our Get a Quote, email us at info@wealthfinancialservice.com and we will be happy to start a conversation on how we can best serve your needs.

With an IUL you can change your life and the life of your future generations

IUL is a type of permanent life insurance, that comes with a cash value component in addition to a death benefit. The money in these cash-value accounts earns annual compound interest based on a stock market index chosen by your insurers, such as the S&P 500 or the Nasdaq Composite.

This means, your money is not in the stock market and you will never lose your principal funds in your account, no matter what happens in the stock market (Because of a 0% floor).

Get your Free Consultation Today

Related Articles

Long Term Care Insurance

Long-Term Care Insurance Long-term care insurance policies are becoming more popular as people realize the need to prepare for their future care needs. Here are some important things to consider when evaluating long-term care policies. The Cost of Long-Term...

Understanding Your Annual Tax Bill to the IRS

Understanding Your Annual Tax Bill to the IRS As a responsible citizen, understanding your annual tax bill to the IRS is crucial. Not knowing how much you pay in taxes could lead to missed opportunities to save money, or worse, IRS penalties. In this post,...

Living Benefits

Living Benefits Rider: The New Insurance Policy You Need Are you tired of paying for insurance that only covers you after you pass away? It's time to consider a new policy that offers living benefits riders, at no extra cost. Living benefits provide policyholders...

Stay Up to Date With The Latest News & Updates

Shipping a Car?

Looking for Auto Transport Services? Look no further. Contact Mission Auto Transport at

Join Our Newsletter

Follow Us